How to Locate the Most Cost Effective Insurance for Your Needs

Wiki Article

The Duty of Insurance Coverage in Financial Planning: Safeguarding Your Properties

:max_bytes(150000):strip_icc()/Life-Insurance-a8aee8e3024145a8b454ea19df030418.png)

Significance of Insurance Policy in Financial Planning

Insurance plays a pivotal role in a person's financial planning strategy, acting as a secure versus unanticipated occasions that might endanger financial security. By mitigating risks related to health and wellness issues, property damages, or liability cases, insurance supplies a financial safety internet that permits individuals to maintain their financial well-being also in unfavorable circumstances.The significance of insurance policy extends beyond plain financial security; it likewise promotes lasting monetary self-control. Routine premium payments motivate people to spending plan properly, guaranteeing that they designate funds for possible threats. Certain insurance products can offer as investment cars, contributing to riches accumulation over time.

On top of that, insurance coverage can improve an individual's capability to take computed dangers in other areas of financial planning, such as entrepreneurship or investment in property. Recognizing that there is a safeguard in position permits greater confidence in seeking possibilities that might otherwise appear discouraging.

Eventually, the combination of insurance coverage right into monetary planning not only secures properties however likewise facilitates a more resilient economic strategy. As people navigate life's uncertainties, insurance stands as a foundational element, allowing them to construct and protect wealth over the long-term.

Sorts Of Insurance Policy to Think About

When assessing an extensive financial strategy, it is vital to take into consideration various sorts of insurance coverage that can deal with various aspects of threat administration. Each type offers a special objective and can shield your possessions from unanticipated events.Medical insurance is essential, safeguarding and covering medical expenditures against high healthcare expenses - insurance. House owners insurance safeguards your building and personal belongings from damage or theft, while also supplying responsibility coverage in instance somebody is wounded on your premises. Auto insurance policy is important for lorry proprietors, providing defense against damage, theft, and responsibility for injuries suffered in mishaps

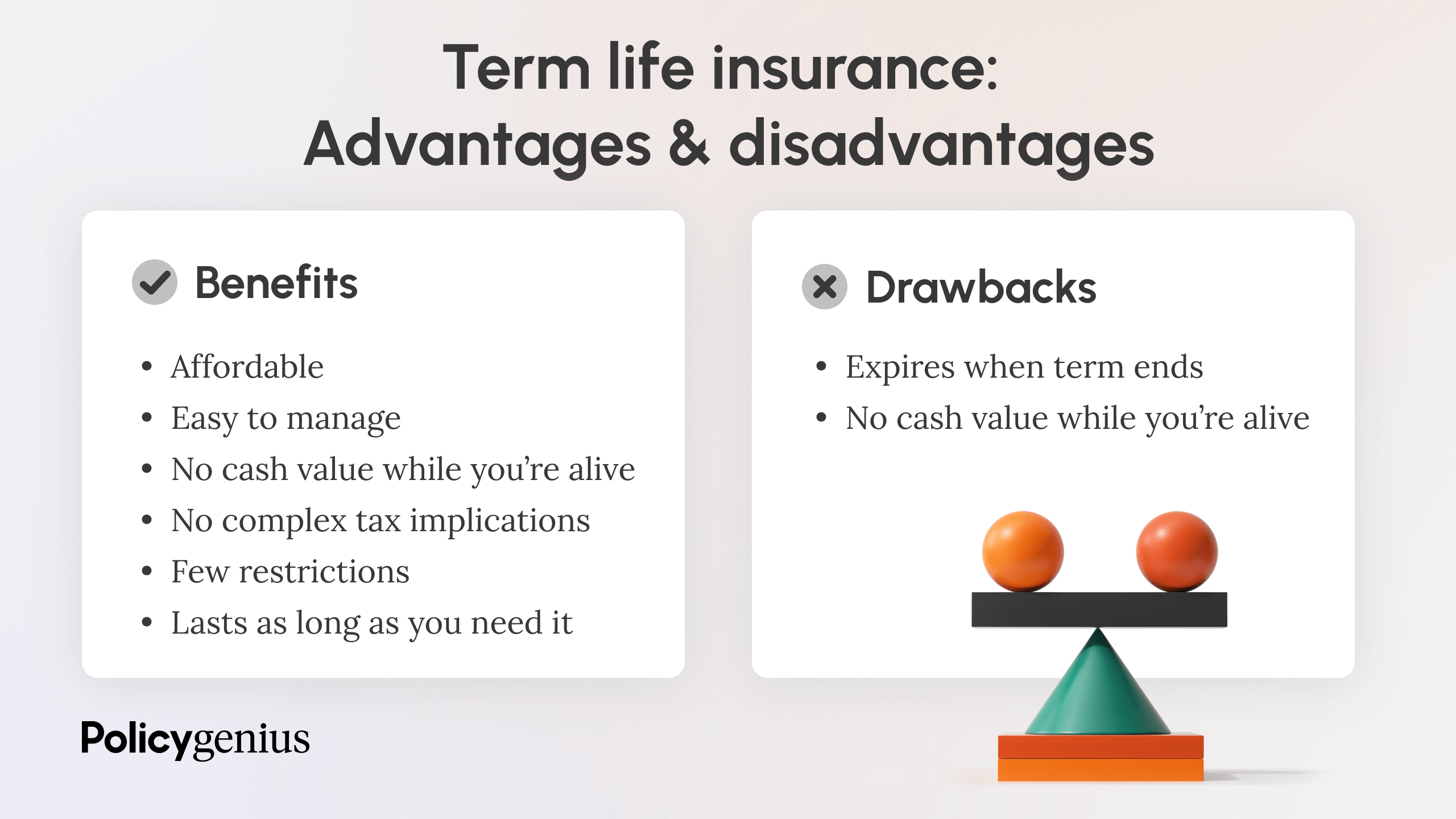

Life insurance policy gives monetary security for dependents in case of an untimely death, guaranteeing their needs are met. Disability insurance policy is similarly crucial, as it changes lost earnings during durations of ailment or injury that stop you from working. Furthermore, umbrella insurance coverage supplies additional obligation insurance coverage past basic plans, giving an included layer of defense against significant claims.

Analyzing Your Insurance Needs

Figuring out the ideal level of insurance coverage is a critical action in securing your monetary future. To examine your insurance policy requires properly, you ought to start by reviewing your existing assets, liabilities, and general economic objectives. This involves thinking about variables such as your income, cost savings, investments, and any kind of financial obligations you might have.Next, determine potential dangers that can impact your monetary security. As an example, evaluate the probability of occasions such as health problem, mishaps, or property damage. This threat evaluation will assist you figure out the types and amounts of insurance needed, consisting of health and wellness, life, special needs, house owner, and car's insurance read more coverage.

Additionally, consider your dependents and their economic needs in the event of your unexpected death - insurance. Life insurance policy may be vital for guaranteeing that enjoyed ones can preserve their lifestyle and meet monetary obligations

Integrating Insurance Policy With Investments

Incorporating insurance coverage with investments is a calculated strategy that enhances economic security and growth possibility. By straightening these two essential elements of economic preparation, people can develop a more resistant economic profile. Insurance policy products, such as entire life or global life plans, typically have an investment component that permits insurance policy holders to build up cash money value gradually. This twin benefit can function as a security web while also adding to long-term riches structure.Additionally, integrating life insurance policy with investment methods can give liquidity for beneficiaries, ensuring that This Site funds are readily available to cover instant expenses or to spend additionally. This synergy permits a more thorough danger administration technique, as insurance policy can secure versus unforeseen situations, while financial investments function towards accomplishing monetary goals.

Additionally, leveraging tax obligation benefits related to particular insurance coverage More about the author products can enhance overall returns. As an example, the cash value development in irreversible life insurance coverage plans may expand tax-deferred, offering an one-of-a-kind benefit contrasted to standard investment lorries. As a result, successfully integrating insurance policy with investments not just safeguards properties however additionally makes best use of development opportunities, causing a durable monetary strategy customized to individual requirements and purposes.

Usual Insurance Coverage Misconceptions Disproved

Mistaken beliefs concerning insurance can dramatically hinder efficient financial planning. One widespread myth is that insurance policy is an unnecessary cost. In fact, it works as an important safeguard, shielding assets and making sure economic stability in times of unexpected events. Numerous people also believe that all insurance coverage are the very same; however, coverage can vary commonly based upon the service provider and details terms. This variation highlights the significance of understanding policy details before choosing.An additional common myth is that younger people do not require life insurance coverage. Additionally, some assume that health insurance policy covers all clinical costs, which is not the case.

Last but not least, the idea that insurance coverage is just helpful during emergency situations overlooks its function in aggressive economic planning. By integrating insurance into your method, you can guard your assets and enhance your general economic strength. Resolve these myths to make enlightened choices and maximize your financial preparation efforts.

Verdict

In verdict, insurance coverage works as a fundamental component of effective monetary preparation, providing essential defense against unforeseen dangers and adding to possession security. By recognizing different sorts of insurance and analyzing private demands, one can achieve a well balanced monetary strategy. In addition, the integration of insurance policy with investment possibilities enhances wealth buildup while ensuring monetary security for dependents. Addressing common mistaken beliefs concerning insurance also promotes educated decision-making, eventually fostering an extra resilient monetary future.In the realm of financial preparation, insurance offers as a foundation for guarding your properties and guaranteeing long-term stability.The importance of insurance extends beyond mere financial security; it additionally cultivates lasting monetary self-control.Misconceptions about insurance can significantly hinder effective monetary planning.Lastly, the idea that insurance policy is only useful throughout emergency situations overlooks its function in positive financial planning.In final thought, insurance coverage serves as a basic component of effective economic preparation, providing necessary defense against unexpected risks and contributing to possession safety and security.

Report this wiki page